One of the biggest worries of Filipinos is debt management. Due to their absence from formal financial institutions, many of them have little or no experience with conventional credit. These are some of the impediments that have contributed to the Philippines becoming Asia-Pacific (APAC”most )’s stressed” nation in terms of household finance management.

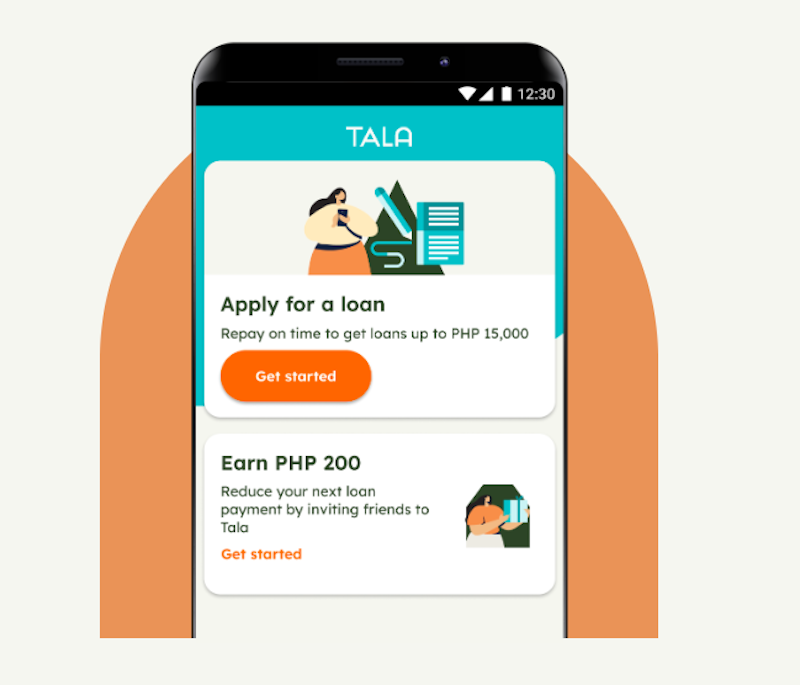

The New Tala Loan addresses these issues and demonstrates that debt management does not have to be tough, with customizable loans that let borrowers pay just for the days they utilize for as little as $5 per day on a $1,000 loan. Customers can also choose to repay their loan between 1 and 61 days.

Customers can calculate the amount they need to repay and avoid “bill shock” thanks to the transparent daily cost. Borrowers save more money when they only pay for the days they need. Unlike other lending platforms, Tala allows its users to return earlier or later than their original repayment date, allowing them to align it with their income cycles while maximizing budget allocations.

“The New Tala Loan is an advancement of our microloan services designed to be more accessible and flexible for a broader range of lifestyles,” stated Tala Country Manager Donald Evangelista. “We have made loans more accessible, so clients can now do what they want with peace of mind, making them more productive and happier with their life.”

Evangelista noted that because the Philippines is Tala’s largest market in Asia, the New Tala Loan was initially launched to Filipino consumers.

Previously, the lowest price for a 1,000 Tala loan was 100 for a minimum of 20 days. Customers might choose an easy-on-the-pocket repayment option of merely 5 per day with the New Tala Loan and pay as soon as 1 day after securing the loan. The improved flexibility and cost-saving benefits of this pay-per-use option are even more apparent for larger loan amounts. For example, if a P15,000 loan is settled within one day, the repayment charge is as low as P75, as opposed to waiting 20 days and incurring a repayment fee of P1,500.

Tala, as usual, provides complete openness on loan costs and terms. Customers may borrow with confidence from Tala since they know they will receive the whole loan amount and will not be charged any hidden or unexpected costs.

Tala meets its global purpose of delivering financial access and credit growth for credit-invisible customers in the Philippines by offering borrowers more opportunities to navigate their financial journey.

Evangelista elaborated on Tala’s entry into the Philippine market, saying, “We began in the Philippines in 2017.” We are quite delighted with our decision, and we hope that more Filipinos can realize their ambitions with Tala. We’re in this for the long haul.”

The New Tala Loan, the first significant advancement of Tala’s trusted digital microloan services, capitalizes on the global company’s capabilities in unique technologies, machine algorithms, and the capacity to understand client needs. Tala will continue to develop tech-powered financial services that help the underserved to confidently manage their financial life, with new products set to hit the market over the next year.